Focusing at High Frequency

An Attention-based Neural Network for Limit Order Books

Job Market Paper

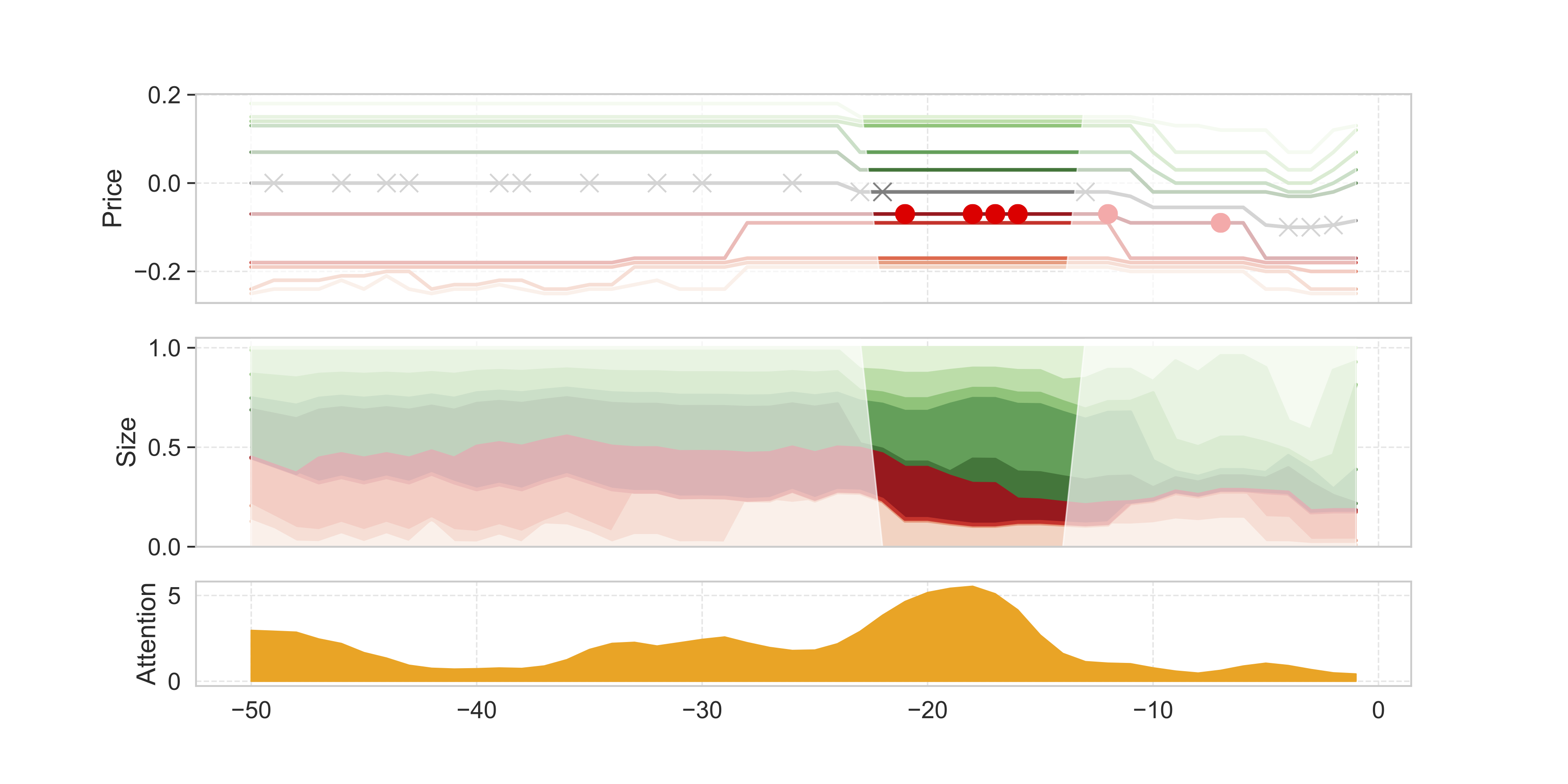

Machine learning methods deliver superior forecasting accuracy but can hardly be used to make inference. To overcome this limitation, I propose an encoder-decoder neural network augmented with an attention-based mechanism that can autonomously learn to identify the most critical regions of the input data. I first train the model using high-frequency message data from the NASDAQ and show that it outperforms other state-of-the-art models in forecasting future transaction prices. Then, I develop a methodology that uses the attention mechanism to make inference on the relative share of information content of market orders versus limit orders, concluding that the most informative events are executions of market orders while submission and cancellations of limit orders are less relevant. Finally, I test the model's behavior during the execution of real block orders from institutional investors, showing that it favors liquidity provision rather than front-running strategies.

Last Revision: 2019-10-22

<<< Back